Potassium Chloride Market Volume to Worth 106.35 Million Tons by 2035

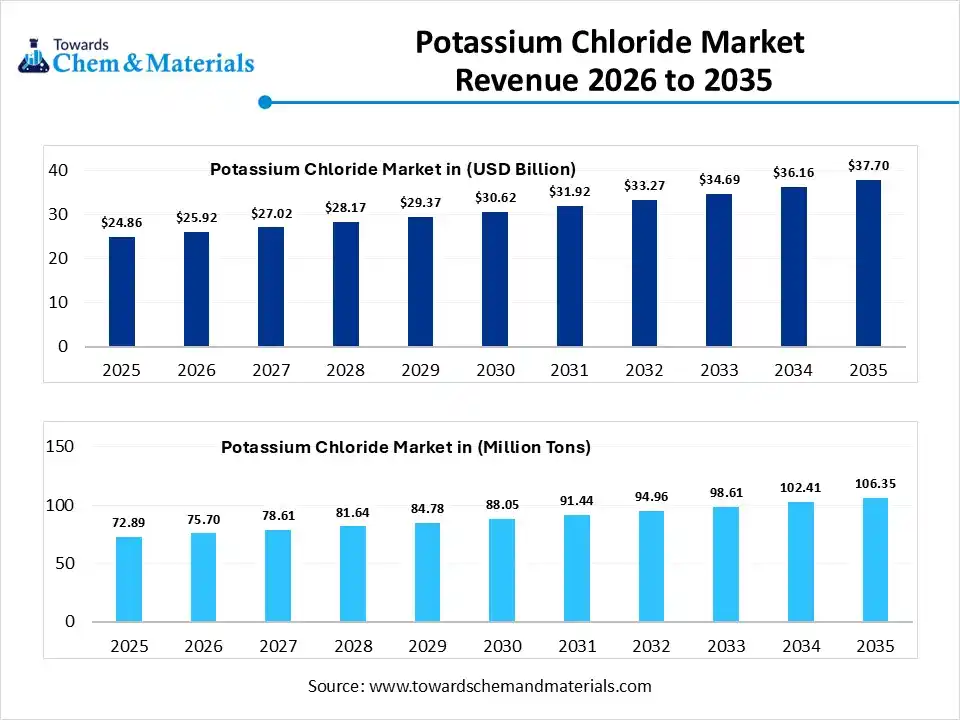

According to Towards Chemical and Materials, the global potassium chloride market volume was valued at 72.89 million tons in 2025 and is expected to be worth around 520.67 million tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 3.85% over the forecast period from 2026 to 2035.

Ottawa, Jan. 27, 2026 (GLOBE NEWSWIRE) -- The global potassium chloride market size was estimated at USD 24.86 billion in 2025 and is expected to increase from USD 25.92 billion in 2026 to USD 37.70 billion by 2035, growing at a CAGR of 4.25% from 2026 to 2035. In terms of volume, the market is projected to grow from 72.89 million tons in 2025 to 106.35 million tons by 2035. growing at a CAGR of 3.85% from 2026 to 2035. Asia Pacific dominated the potassium chloride market with the largest volume share of 36.4% in 2025. The market is driven adoption if sustainable solutions, the need for food security, and the rising demand for industrial and agricultural uses. A study published by Towards Chemical and Materials, a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6140

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Potassium Chloride: Balancing Productivity and Environmental Care for a Sustainable Future

Potassium chloride is a key source for modern agriculture that provides stress resistance, high yield, and improves crop quality. The industry is prioritizing soil integrity and shifting towards sustainable practices to maintain ecological balance. The strategic move towards resource optimization, driving its economic value, ensuring long-term soil health, and preservation.

Potassium Chloride Market Report Highlights

- The Asia Pacific dominated the potassium chloride market with the largest volume share of 36.4% in 2025.

- The potassium chloride market in Europe is expected to grow at a substantial CAGR of 24.62% from 2026 to 2035.

- By grade, the agriculture grade segment dominated the market and accounted for the largest volume share of 38.4% in 2025.

- By form, the solid (crystalline, granular, powder) segment dominated the market and accounted for the largest volume share of 64.4% in 2025.

- By application, the fertilizers (Muriate of potash) segment led the market with the largest revenue volume share of 33.4% in 2025.

- By end-use, the agricultural segment dominated the market and accounted for the largest volume share of 38.5% in 2025.

Potassium Chloride Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 25.92 Billion / 75.70 Million tons |

| Revenue Forecast in 2035 | USD 37.70 Billion / 106.35 Million tons |

| Growth Rate | CAGR 4.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Form, By Application, By End-Use Industry, By Region |

| Key companies profiled | Mosaic Company, Nutrien Ltd., JSC Acron, Belarusian Potash Company, Uralkali PJSC, SQM (Sociedad Química y Minera de Chile S.A.) |

Immediate Delivery Available | Buy This Premium Research Report@https://www.towardschemandmaterials.com/checkout/6140

Government Initiatives for the Global Potassium Chloride Industry:

- India's Nutrient Based Subsidy (NBS) Scheme: The government provides fixed subsidies for potassic fertilizers based on their nutrient content to ensure affordable prices for farmers.

- Canada's Critical Minerals Strategy: Potash is designated as a critical mineral, unlocking federal support for infrastructure and innovation to maintain Canada's position as the world's leading exporter.

- Brazil’s Strategic Trade Framework: The government maintains strategic agreements with major exporters to stabilize import tariffs and secure the long-term supply required for its massive agricultural sector.

- EU Directive on Mining Waste Management: This initiative enforces strict saline discharge limits and mandates advanced tailings storage technologies to reduce the environmental footprint of potash mining.

- India's PDM Incentive Program: The government recently inducted Potassium Derived from Molasses (PDM) into its subsidy scheme to encourage domestic production from sugar industry byproducts.

- China's Food Security Mandates: The Chinese government prioritizes potash supply security through state-managed rail shipments and increased domestic production to stabilize grain yields.

- Indonesia's Fertilizer Expansion Policy: In 2024, the government doubled the quantity of subsidized fertilizers, including NPK blends containing potash, to support smallholder productivity.

- Saskatchewan’s Regional Development Partnership: The Canadian government invests in regional infrastructure to prepare local and Indigenous communities for large-scale potash projects like the Jansen mine.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6140

What are the Major Potassium Chloride Market Trends

- Sustainability and Green Production: The increasing focus on reducing environmental impact and strict regulations is driving the adoption of sustainable solution including water recycling systems, and advanced solution mining techniques in the industrial sector.

- Supply Chain Realignment: The strategic push for diversifying sources and investment in domestic production enhances flexibility and vertical integration of mining operations.

- Rising Demand for Food Security: The growing population is driving the need to maximize crop yields, where Muriate of potash enhances crop resilience and quality that shaping the market.

- Expansion of Non-Agricultural Applications: The rapidly growing concern for health and electrolyte imbalance in aging population is driving demand for potassium chloride in food, pharmaceutical and industrial uses.

Potassium Chloride Market Dynamics

Driver

Rising Demand from Agriculture and Fertilizer Applications

The potassium chloride market is driven by its vast use in potassium-based fertilizer to increase soil fertility and crop yield. The growing commercial farming methods and knowledge of balanced nutrient application are driving the demand for potassium chloride for developing agricultural economies and food productivity.

Restraints

Price Volatility and Supply Chain Constraints

The market is restrained because of fluctuations in the cost of raw materials, dependent on mining operations and disruptions to supply chains. The transportation expenses and trade restrictions affect the pricing and availability, limiting the market expansion and uncertainty for end-users.

Opportunity

Expanding Industrial and Pharmaceutical Applications

Potassium chloride is increasingly utilised in industrial applications, and pharmaceutical formulations offer the market significant growth. Non-agricultural usage is driven by rising processed food consumption and healthcare demand for electrolyte renewal solutions due to an aging population. Additionally, innovation in the market is emerging, increasing industrialization, and advances in production technologies.

Smart Solutions, Smarter Markets: Technology Transforming Potassium Chloride Production.

The technological advancement in potassium chloride production focuses on improving extraction efficiency, impurity reduction, and lowering environmental impact. The advanced mining techniques improve resource recovery and lower operational expenditure. By integrating AI to optimize soil nutrients, minimize environmental impact, supply chain transparency, and enhance crop yields.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Potassium Chloride Market Segmentation Insights

Grade Insights

How did the Agriculture Grade Segment dominate the Potassium Chloride Market?

The agriculture grade segment is the leading market, driving global crop vitality and high-density farming. Muriate of Potash (MOP), as the most bioavailable and cost-efficient potassium source, supports soil productivity, enhances plant immunity, and improves drought resistance. Its leadership is driven byits property to protect against nutrient loss during intensive farming. It bridges the gap between shrinking arable land and rising nutrient-dense food demand, remaining fundamental to potassium chloride growth and global food security.

The pharmaceutical(medical) segment is anticipated to grow fastest, powered by increased focus on clinical health and electrolyte management. As healthcare needs risen with aging populations and chronic illnesses, potassium chloride has become vital in intravenous (IV) infusion and oral supplements for hypokalemia. The shift toward ultra-high purity for advanced drugs and renal care fuels expansion, making it a value-added leader.

Form Type Insights

How Solid (crystalline, granular, powder) Segment Dominates the Potassium Chloride Market?

The solid (crystalline, granular, powder) Segment dominates due to its logistical advantages and physical stability. Granular forms suit large-scale heavy industry and agriculture for mechanical spreading, while crystalline and powder forms enable rapid solubility in chemical and drug formulation. Its ease of transport and storage reduces costs, and its compatibility with global supply chains makes it the standard across bulk and high-precision applications.

The liquid (solution/brine) segment is experiencing the fastest growth in the market during the projected period due to its efficiency in high-precision applications. Driven by a surge in automation systems in industry and agriculture, liquid formats offer better solubility and immediate bioavailability, allowing for precise dosing and integration into fertigation and hydroponic systems for technical precision and resource optimization in future growth.

Application Insights

Which Application Segment Dominates the Potassium Chloride Market?

The fertilizers (Muriate of potash) segment maintains its market dominance because it is crucial for soil health and high-yield crop production. MOP improves plant resilience, nutrient uptake, and harvest quality under environmental pressures. Its role as a vital input for food security bridges the gap between soil mineral depletion and modern farming demands, providing a reliable, cost-effective foundation for large-scale agriculture.

The pharmaceutical & medical segment offers significant growth during the projected period. Due to rising chronic health conditions like cardiovascular and nephrological disorders, ultra-pure potassium chloride is in high demand for electrolyte therapies and treatments. Stricter regulations and advanced purification established these segments, ensuring safety standards for life-saving formulations. As healthcare infrastructure and the aging population grow, it is driving towards high-margin innovation opportunities.

End-Use Insights

How did the Agricultural Segment Dominate the Potassium Chloride Market?

The agricultural segment continues its leadership in the market, driven by its pivotal role in optimizing plant physiology and harvest quality. In this segment, potassium chloride acts as a key catalyst for enzymatic activation and photosynthesis efficiency, crucial for producing nutrient-dense crops. The rising demand for high-intensity cultivation, for large-scale soil fortification in global landscapes, and the surging demand for the global food supply chain due to its superior durability and affordability.

The pharmaceutical segment is an emerging segment projected to grow at a CAGR between 2026 and 2035. The market is propelled by a global shift towards precision medicine and the rising need for high-purity involvement in geriatric care and chronic disease management. For innovation in ultra-pure formulation, potassium supplements play a key role in life-sustaining intravenous fluids and haemodialysis concentrates, making it a dynamic end-use segment globally.

Regional Insights

How did Asia Pacific Dominate the Potassium Chloride Market?

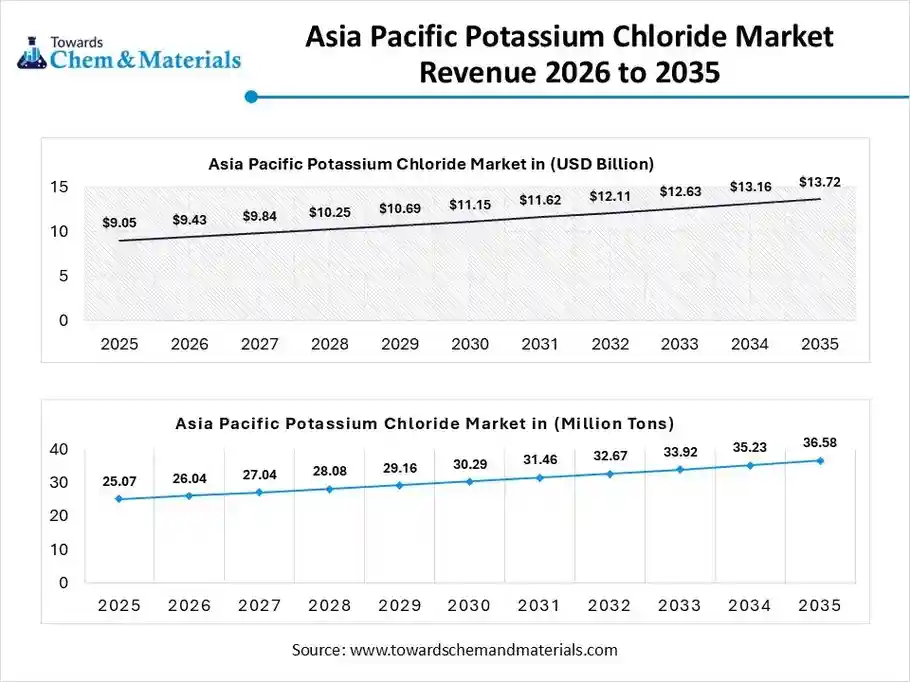

The Asia Pacific potassium chloride market size was valued at USD 9.05 billion in 2025 and is expected to be worth around USD 13.72 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.27% over the forecast period from 2026 to 2035.

The Asia Pacific potassium chloride market volume was estimated at 25.07 million tons in 2025 and is projected to reach 36.58 million tons by 2035, growing at a CAGR of 4.11% from 2026 to 2035.

The Asia-Pacific region leads the market due to its role in global agriculture and industrial innovation. The need to boost productivity on limited land and the adoption of nutrient management strategies have made it the largest potash consumer, supported by a vast industrial sector. using potassium chloride in chemical manufacturing and technological applications. Overall, the agricultural and industrial growth shapes global demand and stability.

India Potassium Chloride Market Trends

India's market is closely linked to agricultural demand, as it is a key input for potash-based fertilizers used to improve crop yields. Long-term growth is supported by rising food demand and government fertilizer subsidy programs that encourage balanced nutrient usage. The market remains heavily dependent on imports, making it sensitive to global supply conditions and price volatility.

Why is Europe the Fastest-Growing Region in the Potassium Chloride Industry?

Europe is emerging as a key growth hub in the market, shifting toward high-value uses. While agricultural demand stays steady, growth is driven by strict health laws and sophisticated consumer trends. By expansion in the pharmaceutical and food sectors, use potassium chloride as a low-sodium alternative and medical material, driving Europe's leadership in high-purity applications and innovation segments.

Germany Potassium Chloride Market Trends

Germany's market shows steady, moderate growth, supported by demand from both agriculture and industrial applications. The fertilizer segment remains the primary driver, with potassium chloride widely used in cereal and crop production across the country. The market is sensitive to global supply and price movements, as sourcing relies significantly on international trade and mining outputs.

Recent Breakthrough in Potassium Chloride Industry

In February 2025, National recall of potassium chloride injection of 20 mEq and potassium chloride injection of 10 mEq was issued by ICU Medical due to Mislabeling. FDA post companies announcement as public service act. (https://www.fda.gov/safety/recalls-market-withdrawals-safety-alerts/icu-medical-issues-nationwide-recall-potassium-chloride-injection-20-meq-and-potassium-chloride)

More Insights in Towards Chemical and Materials:

U.S. Polyvinylidene Chloride (PVDC) Coated Films Market Size to Hit USD 686.84 Mn by 2034

Polyvinyl Chloride (PVC) Market Size to Reach USD 116.26 by 2034

Ammonium Chloride Market Size to Reach USD 3.52 Billion by 2034

Europe Green Chemicals Market Size to Reach USD 11.23 Billion by 2034

Asia Pacific Green Chemicals Market Size to Hit USD 139.20 Bn by 2034

Asia Pacific Sustainable Chemicals Market Size to Surge USD 59.74 Bn by 2034

Green Chemicals Market Size to Surpass USD 29.49 Billion by 2034

Crop Protection Chemicals Market Size to Surpass USD 163.08 Bn by 2035

Water Treatment Chemicals Market Size to Reach USD 58.16 Bn by 2034

Industrial and Institutional Cleaning Chemicals Market Size, Report 2034

U.S. Construction Chemicals Market Size to Surpass USD 25.90 Bn by 2034

U.S. Agrochemicals Market Size to Surpass USD 42.69 Bn by 2034

Europe Industrial and Institutional Cleaning Chemicals Market Size to Reach USD 39.50 Bn by 2034

Europe Water Treatment Chemicals Market Size to Surpass USD 20.66 Bn by 2035

Aroma Chemicals Market Size to Surpass USD 11.63 Billion by 2035

Specialty Oilfield Chemicals Market Size to Hit USD 26.03 Bn by 2035

Oilfield Chemicals Market Size to Reach USD 53.38 Bn by 2035

Nanochemicals Market Size to Surpass USD 43.93 Billion by 2035

Industrial Cleaning Chemicals Market Size to Surpass USD 81.97 Billion by 2035

Precision Chemicals Market Size to Hit USD 127.16 Bn by 2035

U.S. Oleochemicals Market Size to Surpass USD 9.54 Billion by 2035

Europe Petrochemicals Market Volume to Surpass 45.10 Million Tons 2035

Carbon Capture Utilization Chemicals Market Size to Hit USD 527.01 Bn by 2035

Sustainable Paper Chemicals Market Size to Hit USD 62.12 Billion by 2035

Performance Chemicals Market Size to Hit USD 582.98 Billion by 2035

Top Companies in Potassium Chloride Market & Their Offerings:

- The Mosaic Company: Offers diverse grades of muriate of potash (MOP), including specialized granular, standard, and fine formulations tailored for various soil types and application methods.

- Nutrien Ltd.: Provides high-purity potassium chloride through its extensive network of Canadian mines, focusing on large-scale production of MOP for global agricultural use.

- JSC Acron: Produces potassium chloride primarily as a raw material for its internal NPK fertilizer production and as a standalone mineral fertilizer for international export.

- Belarusian Potash Company: Acts as the dedicated trade arm for Belaruskali, supplying pink and white MOP in granular and powder forms to global markets.

- Uralkali PJSC: Supplies a comprehensive range of potassium chloride products, including granular and standard MOP as well as technical-grade KCl for industrial applications.

- SQM (Sociedad Química y Minera de Chile S.A.): Focuses on potassium chloride extracted from brine, offering specialized soluble products ideal for fertigation and high-tech irrigation systems.

Potassium Chloride Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Potassium Chloride Market

By Grade

- Agriculture Grade

- Industrial Grade

- Pharmaceutical (Medical) Grade

- Food Grade

By Form

- Solid (Crystalline, Granular, Powder)

- Liquid (Solution / Brine)

By Application

- Fertilizers (Muriate of Potash)

- Industrial (Metallurgy, Chemical Manufacturing, De-icing)

- Pharmaceutical & Medical

- Food Processing

- Others (Water Treatment, Laboratory Uses)

By End-Use Industry

- Agricultural

- Chemical Industry

- Pharmaceutical

- Food & Beverage

- Others (De-icing, Water Treatment)

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@

https://www.towardschemandmaterials.com/checkout/6140

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.